To Know Thyself is the Beginning of All Wisdom [Aristotle]… and as it turns out, it’s also the beginning of your Brand Strategy

At SIVO Insights, we spend a lot of time helping our clients understand who their consumers are, what they need and why. It is just as important to help our clients understand the competitive context within which they operate, to understand where and how their brands can differentiate and create an ownable competitive advantage.

We work with our clients using a three-pronged approach to set a solid brand strategy:

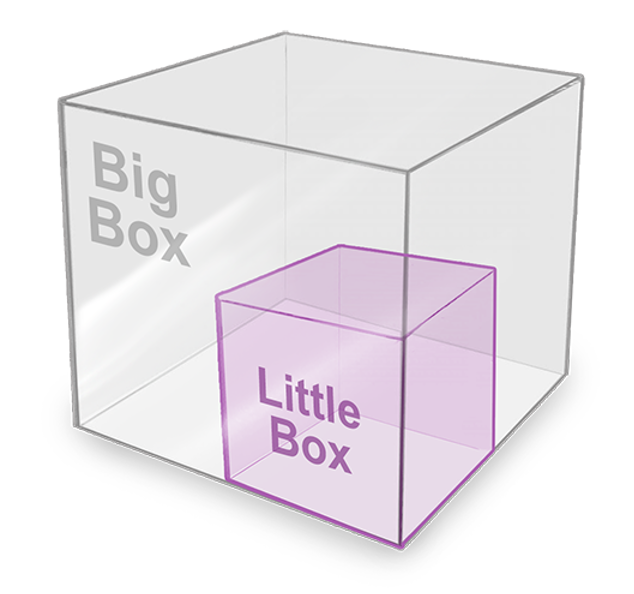

BIG BOX, LITTLE BOX

A simple exercise that teams can use to consider and articulate the market that their brand best competes in, is the “Big Box, Little Box” Model.

In this model, teams define the market, or “Little Box” that they believe their brand currently operates in, and what benefits they distinctly deliver to that market. Next, the team considers a broader market definition, the “Big Box”, to understand who is in the brand’s expanded list of competitors and what benefits their product could distinctly deliver in that broader context. By doing this exercise, the team broadens their view of who they are truly competing with and where they can source volume. This helps teams reframe how they present their brand and its ownable benefits to the world. i.e., the brand positioning, which in turn, impacts future renovation, innovation, and communication efforts.

Trending

Do customers want to ‘hire’ your product?

CONSIDER THIS EXAMPLE

A team that manages a coffee brand might define their “Little Box” as the Coffee category. In that competitive context, the team will likely focus on functional coffee benefits such as richest flavor or best price, to compete with other coffee brands. But when they broadened their view of the competitive context to the “Big Box”, they might find that they are competing with the broader ‘caffeinated beverage’ market. In this context, the key benefits that the team may focus on to differentiate and compete with caffeinated sodas and energy drinks would be things like “warmth, comfort, and enabling your morning ritual.”

INFORM YOUR STRATEGY

The big box, little box model allows teams to…

Discover who they are truly competing with

Reframe their brand strengths within the broader, and likely more accurate, competitive context

Identify which brand benefits are most ownable and distinctive vs. the competitive set

Reconsider who their target consumer is and how to position the brand to meet the needs of this larger consumer target group

SIVO INSIGHTS ACTION PLAN

Our experts can…

Facilitate a Big Box/Little Box exercise with your team

Execute a qualitative exploration to understand where your brand truly competes

Execute an Attitude and Usage (A&U) study to quantify which competitive products/categories are true competitors

Facilitate a workshop, using the learning above, to rethink and redefine brand strategy

Contact us at Contact@SIVOInsights.com for more information and next steps.